Voluntary Carbon Market Reports

Explore some of our latests VCM reports below, including regular corporate buyers reports, general market trend reports, forecasting and CDR reports!

VCM & Forecast Reports

CORSIA: Market Developments and Forecast Scenarios

Explore the future of CORSIA credits in the Voluntary Carbon Market with our latest report, offering an in-depth analysis of supply, demand, and pricing trends and forecasting scenarios.

Key Insights:

-

Only 15 million credits currently meet CORSIA’s eligibility for the First Phase, this is less than 10% of projected demand.

-

Demand from aviation and other sectors is surging, with prices projected to reach $14–$16 per credit by 2027.

-

Policy frameworks and enforcement mechanisms will shape market outcomes, with undersupply potentially driving prices above $20 per credit.

This report provides essential forecasting scenarios to help the market make sense of supply constraints, anticipate pricing trends, and ensure compliance in an evolving regulatory environment.

Forecasting Prices, Supply & Demand in the Voluntary Carbon Market

Our new forecast report leverages years of data and analysis to present critical future trends for the voluntary carbon market.

Among other things, in the report, we review some of the key findings from our Base Case Scenario. The base case below projects a growth scenario that sees companies offsetting a portion of their missed targets. Here we expect the market to grow slowly until 2032, as oversupply of credits means that there is enough supply to satisfy demand until that year.

The primary market value stays in the single digits until 2033, at which point it quickly increases, reaching ~$40b by 2040 (in nominal terms).

Download the report for more information!

Download

VCM 2024 Review &

Emerging Trends for 2025

In this report, we analyze the latest trends in the Voluntary Carbon Market, highlighting the growing focus on quality and the shift toward removal-based credits like NBS and engineered solutions.

We explore key developments, such as ICVCM’s first CCP approvals, increased off-take agreements, and the integration of VCM credits into compliance markets.

To conclude, we discuss the challenges and opportunities ahead, from outdated credits to the potential impact of Article 6, offering insights into what’s next for the VCM.

Download

Corporate Emissions Data & Findings

In this report, we take an in-depth look at recent corporate emissions data and emerging trends.

We begin with an overview of AlliedOffsets’ Corporate Emissions Data, focusing on developments in Scope 1, 2, and 3 emissions over the past three years.

We then continue with insights into our data collection process, highlighting key learnings and outlining our methodology for data gathering and analysis. Following this, we delve into our main findings across Scope 1, 2, and 3 emissions, examining sector-specific shifts since 2019.

To conclude, we present a table featuring selected companies, showcasing how their Scope emissions have decreased (or increased!) over the last year!

DownloadCorporate Buyer Reports

February 2025 Corporate Buyers Report

Our last corporate buyers report is live…

Starting next month, we are excited to launch our revamped Monthly Buyers Report as the new Monthly Corporate Buyers Newsletter! This update is designed to provide our subscribers with unique and comprehensive insights about corporate buyers in the carbon market, delivered conveniently to their inbox.

Similar to our reports, this newsletter will feature key trends, analysis, and updates to keep you informed of corporate buying behavior. Download the last report and find the link to sign up for the newsletter!

Download

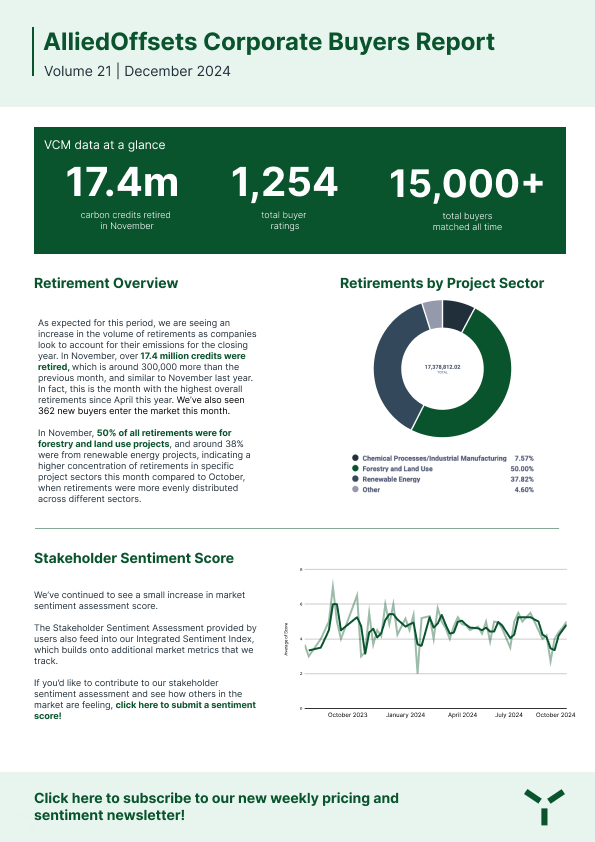

December Corporate Buyers Report

December’s buyers report is live!

In November, over 17.4 million credits were retired, which is around the same as last year.

As always in this report, we do a deep dive into the latest buyer trends including retirements by sector, by project developers and projects.

Download the report here!

DownloadPolicy Reports

Converging Pathways: The Intersection of Article 6 and the VCM

In this report, we provide a comprehensive overview and analysis of key trends and insights shaping the carbon markets. Our focus spans several areas, including the ongoing progress of Article 6.2 cooperative agreements, the latest on Article 6.4 project transitions, and an evaluation of compliance-eligible credits across various schemes like CORSIA and domestic carbon levies. We also go into detail about the growing convergence between voluntary and compliance markets, highlighting the increasing use of VCM credits for regulatory purposes.

Download the full report for more details!

Download

Credits Bridging Voluntary and Compliance Carbon Markets

Our new policy report sheds light on the intersection between the voluntary and compliance markets.

In this policy report, we cover:

- The availability of VCM/Compliance credits

- Demand and supply trends of compliance-eligible VCM credits

- The top buyers of compliance-eligible credits

- Chile’s Green Tax Scheme, Singapore’s carbon tax-eligible credits, and much more!